Interest rate swap markets have been highly volatile over the past year, driven by evolving economic data, central bank policy shifts, and broader financial market conditions. In this article, we analyse how GBP swap rates have moved over the last 6 to 12 months, using key market data and charts to provide insights into evolving trends and expectations for the future.

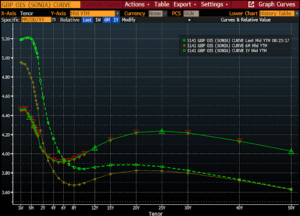

The GBP OIS (SONIA) swap curve has changed significantly over the past year:

Recent movements in the 5-year and 10-year GBP swap rates indicate a shift in market expectations:

The GBP 2s10s swap spread, which measures the difference between 2-year and 10-year swap rates, provides key insights into market sentiment:

Historically, an inverted swap curve is seen as a signal that the economy may be slowing, prompting central banks to shift toward a looser policy stance.

The relationship between GBP swap rates, the Bank of England base rate, and SONIA (Sterling Overnight Index Average) provides insights into how markets anticipate interest rate changes.

When swap rates fall below the BoE base rate, it typically reflects market confidence that the central bank will start cutting rates soon. However, the recent uptick in 5Y and 10Y swaps suggests that markets may be reconsidering how low rates will actually go over the long term.

For businesses considering hedging strategies, this shift highlights the importance of evaluating whether locking in swaps now provides a better opportunity than waiting for potential further declines.

Market-implied rate expectations from Overnight Index Swaps (OIS) pricing indicate:

These projections reinforce the gradual easing path that markets expect from the BoE, rather than a sharp pivot to lower rates.

What’s Next?

Looking ahead, the key drivers for swap rates include:

The market continues to watch for BoE forward guidance and key inflation prints to determine the timing and magnitude of future cuts. Businesses with exposure to floating rates should consider hedging strategies, given that uncertainty remains around the pace of policy easing.

The past year has seen a significant shift in GBP swap rates, driven by evolving central bank policy expectations and global economic conditions. Markets now expect the BoE to begin cutting rates within the next six months, with short-term swap rates already declining in anticipation.

However, longer-term rates remain stable, suggesting that while monetary easing is expected, borrowing costs are unlikely to return to the ultra-low levels seen in previous years. Businesses with interest rate exposure should remain proactive in managing their hedging strategies to navigate this changing landscape.

If you would like to discuss any of the above in further detail, please get in touch and a member of our team will be able to assist you.

If you have not previously read our article on independent interest rate caps, please click here.

You can view GBP swap rates on our Daily Market Rates sheet by clicking here.

You can reach us on 0207 183 2277 or at info@vedantahedging.com.