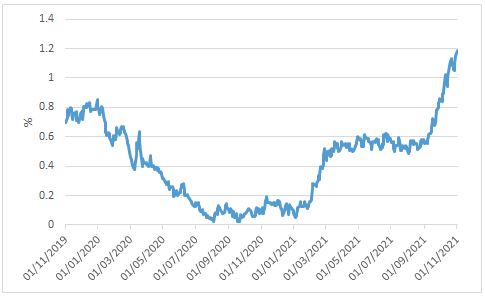

With traders betting on imminent rate rises by the Bank of England starting as early as this week, the last two months have seen significant rises in swap rates from the historically low levels brought about by the worldwide pandemic. It wasn’t so long ago when negative rates were on the horizon but the complete ‘U-turn’ in the prediction of rates has led to a hike in borrowers entering into interest rate hedging.

The outcome of the MPC meeting this week is probably the most unpredictable since the start of the pandemic. The market is pricing a rise in the UK Base Rate to 0.25% with expectations that the majority of the members of the MPC will support tighter monetary policy. However the recent increase in rates (as can be seen in the chart above) has already begun to play a role in tightening borrowing conditions leading to the possibility of an early Base Rate rise being premature. Whether the MPC commence the rate rises this week or not, hedging floating rate debt will continue to be at the forefront of business decisions for the next few months. The expectation is that rates will be at their highest levels since the 2007/2008 financial crisis by the end of 2022.

We have seen a substantial rise in existing and new clients entering into hedging with their lenders as well as through independent hedging. We work with a panel of independent cap providers who are able to offer both Base Rate and SONIA caps. Please click here to view our article on independent interest rate caps.

Please get in touch with any questions you may have and a member of our team will be able to assist you.

You can reach us on 0207 183 2277 or at info@vedantahedging.com.